Partner Retail Account Applications 1.0.0

API for our Partners to digitally submit an application for on-boarding of a new retail customer and open an account.

Overview

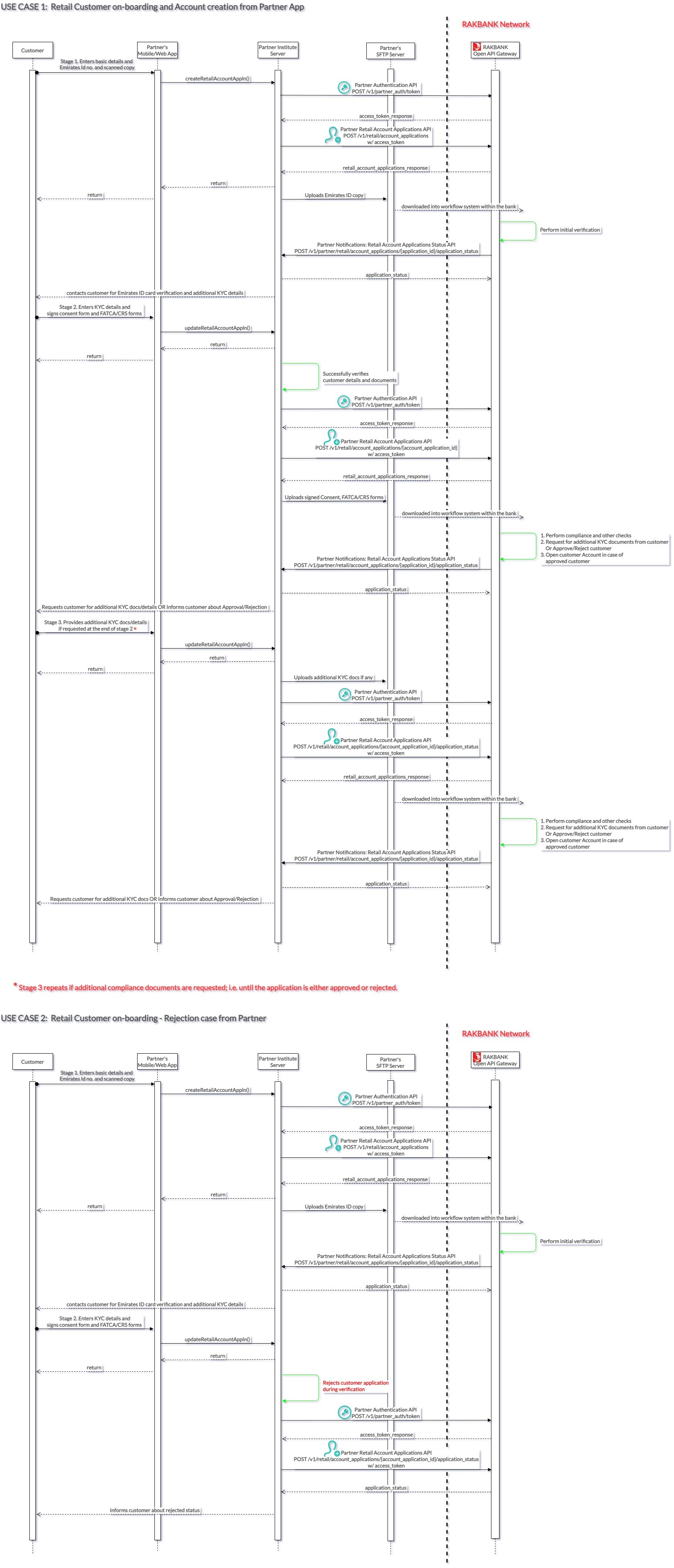

The Partner Retail Account Application API is available to partner institutions to initiate the basic account opening process for their new retail customers and to update KYC details of the customer once document verification is completed from their end. The scanned documents need to be uploaded separately to a SFTP server. Post verification of the documents by the RAKBank operations and compliance teams, the customer onboarding and account opening would be completed and the status would be notified to the partner.

The on-boarding process invloves three stages during which the Partner Retail Account Application API is invoked by the Partner:

- Stage 1 : The applicant enters his/her basic details and uploads scanned copy of the Emirates ID on the Partner App

- Stage 2 : The partner performs physical verification of the applicant's Emirates ID and collects KYC details, signed Consent and FATCA/CRS form copies of the applicant

- Stage 3 : The applicant provides additional KYC documents/details if requested at the end of Stage 2 by RAKBank Compliance Team

At every stage, the status of the application will be notified to the client using the Partner Notifications: Retail Account Application Status API. The notifications would be sent at three stages as mentioned below. Stage 2 is optional and may apply only to certain individuals where additional details or documents are required by the Bank's Compliance team to process the application.

- Stage 1 : Initial verification when the application is first created with basic details

- Stage 2 : Request for additional Know Your Customer (KYC) details/documents of the customer

- Stage 3 : After final processing with REJECTED or PROCESSED_SUCCESSFULLY status

The partner is expected to host the notification API on their server as per the documentation provided. The "API Docs" sub menu on this page provides the links to the documentations of both the APIs.

Related APIs

Any update in personal details of all New-To-Bank (NTB) customers, i.e. customers that do not hold any bank products other than the retail account opened by the Partner, must be updated in the bank records, using the Partner Customer Profile Update API.

Use cases

Digital Onboarding & Account Opening for Partner Customers

Allow new propective customers to quickly fill in basic details and apply for a retail account.

KYC Details submission for Partner Customers

Visit the customer at his/her convenient time and collect his/her KYC details. Post physical verification of customers identity documents, submit the KYC details to the bank using this API.