RAKBANK Customer Registration to Third Party Apps 2.0.0

Intimate RAKBANK whenever our customers register on your App to instantly allow the customer to link his/her bank account to your App.

Overview

The RAKBANK Customer Registration to Third Party Apps API is available to FinTechs and Third Party App (TPA) developers to intimate us whenever a RAKBANK Business Banking customer registers on their App, instantly allowing the customer to link his/her bank account to the Third Party App. Post registration, the customer can initiate bank linkage from the TPA and provide consent as part of OAuth Authorization Code flow. For more information on the OAuth Authorization Code flow, see RAKBANK Customer Sign-in OAuth API.

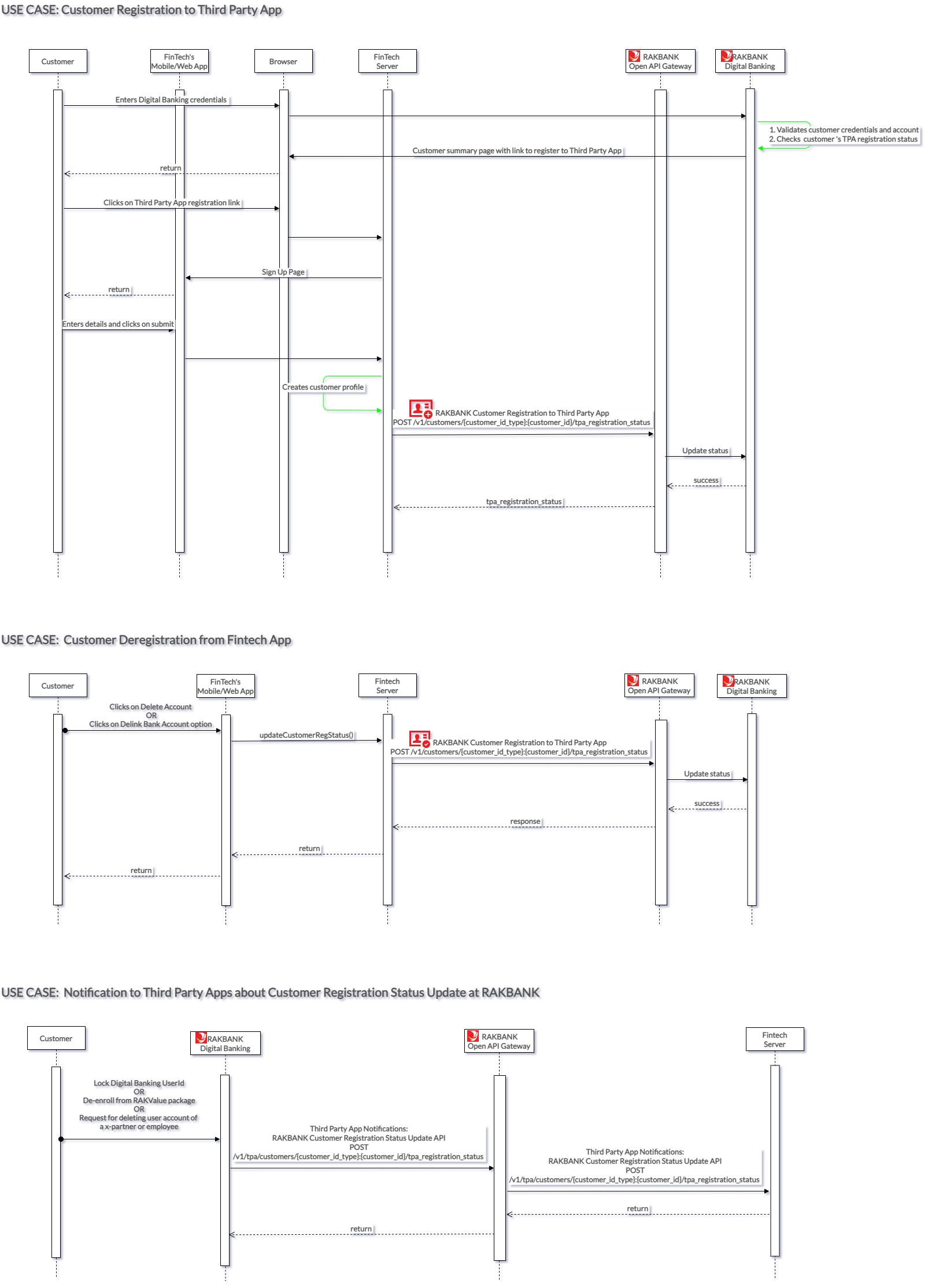

The RAKBANK Customer Registration to Third Party Apps API would be invoked in the following scenarios:

- SCENARIO 1 : A business banking customer who has enrolled to a RAKValue SME package registers himself/herself on the Third Party App.

- SCENARIO 2 : A business banking customer, previously registered on the Third Party App and linked his/her bank account to the TPA, initiates bank account delinkage from the Third Party App.

- SCENARIO 3 : A previously registered business banking customer, closes/deletes his/her account on the Third Party App.

Related Notification API

Certain events within the bank can lead to customer deregistration or delinkage from the Third Party App. The Third Party App Notifications: RAKBANK Customer Registration Status Update API allows RAKBANK to intimate FinTechs & Third Party App back-ends (TPA) about updates in customer registration and account linkage status. The API would be invoked in the following scenarios:

- SCENARIO 1 : A business banking customer, previously registered on the Third Party App and linked his/her bank account to the TPA, has accidentally locked his/her RAKBANK Digital Banking account. The customer would be restricted from accessing his/her bank account from the TPA as well. RAKBANK will notify the TPA about the delinked status of the customer using this API. The customer can reinitiate bank linkage from the TPA by providing consent as part of OAuth Authorization Code flow, after his/her Digital Banking account is unlocked. For more information on the Auth Authorization Code flow, see RAKBANK Customer Sign-in OAuth API.

- SCENARIO 2 : A business banking customer, previously registered on the Third Party App, resigns from the company. The customer's Digital Banking access will be removed and instantly deregistered from the Third Party App as well. RAKBANK will notify the TPA about the deregistered status of the customer using this API.

- SCENARIO 3 : A business banking customer, previously registered on the Third Party App as part of RAKValue SME package, de-enrolls from the RAKValue package. The customer and all related users of the company will be instantly deregistered from the Third Party App as well. RAKBANK will notify the TPA about the deregistered status of the customer using this API.

The FinTech is expected to host the notification API on their server as per the documentation provided. The "API Docs" sub menu on this page provides the links to the documentations of both the APIs.

Use cases

Business Banking Customer Registration to Third Party Apps

Intimate us whenever a RAKBANK Business Banking customer registers on your App, instantly allowing the customer to link his/her bank account to your App.

Business Banking Customer Deregistration & Delinkage from Third Party Apps

Intimate us whenever a RAKBANK Business Banking customer deregisters or delinks his/her bank account from your App, to ensure that the customer can reinitiate registration and bank linkage smoothly.